Revenue and Receivables

Contents

Revenue and Receivables¶

Unredeemed Gift Certificate¶

The gift certificate when not redeemed by the customer should not be included in the sales revenue totals as it satisfies the realization criteria but not the earned criteria.

This unredeemed gift certificate should be recorded in deferred revenue account.

“Deferred revenue is future revenue that has already been collected but has yet to be earned. It is shown in the liabilities section of the balance sheet.”

Other examples of deferred or unearned revenue include: magazine subscriptions sold by publishers sometimes a year or more in advance of delivering the magazines, advance sales of airline tickets or theatre and sporting events, sales of coupon for future services such as free upgrades on computer software.

“The sale of gift certificate and other similar revenue sales transaction must remain on the balance sheet and cannot go into the income statement as revenue until it is both earned and realized.”

Once the revenue is realized, then deferred account is debited and sales account is credited.

Bad Debt¶

Estimation¶

Allowance account can be used for bad debts.

“The purpose of an allowance account is to record your accounts receivable at the amount you expect to receive in the future.”

To create an allowance, entity must start by estimating the amount of in a particular period in accounts receivable that might eventually become bad debts.

“Based on their past experience, some companies assume that bad debts will be a constant percentage of accounts receivable. Not knowing which accounts receivable will actually not be paid, they use the percentage to calculate the allowance for bad debts.” Some companies follow another approach. They “age” their receivables - grouping them by the number of days they are overdue, since older ones are more likely to be converted to bad debts. These methods are called allowance methods.

There is a third approach is used for tax purposes. It is the direct write-off method. In this method, bad debt is only recognized when the related receivable goes bad.

Allowance set up¶

“To record the bad debt expense two new accounts must be set up - the allowance for bad debts account and the bad debt expense account.”

“For journal entry purposes, the allowance for bad debts account is treated like a liability account.”

“The bad debt expense account is an income statement account.”

Generally, bad debt expenses is rolled in to total general and administrative or operating expenses.

Write-offs¶

“The final step is to record a bad debt write-off when it becomes clear that a particular customer cannot pay the debt.”

The net effect on the balance sheet will be 0. There is no impact on total assets, liabilities and retained earnings.

Refunds¶

Use the allowance method used for bad debts to account for the possibility of returns

Estimating¶

“Most companies make an estimate of the amount of their sales that will be returned based on previous experience.”

Allowance set up¶

“To recognize the returns and accompanying refunds, you create a liability account called “Allowance for sales returns”.”

“The Estimated Sales Refund account balance is a deduction from gross sales. On the income statement this account is renamed and appears as ‘Allowance for sales returns’. Do not let this renaming of the income statement account confuse you. The liability account of the same name is still on the balance sheet.”

Actual Returns¶

The final step is to record the actual returns.

The allowance for refunds account appears in the end of the period financial statements as a liability account. When the refund takes place, cash is credited (a minus to an asset account) and the allowance account is debited (a minus to a liability account) thus reducing Assets and Liabilities by the same amount. The income statement and hence retained earnings would not be affected.

Prompt Payment Discounts¶

The incentive provided in the form of discount to the customer for prompt payment for the goods purchased is known prompt payment discount.

We follow the allowance accounts method for prompt payment discounts too.

Estimation¶

Company’s past experience is used to estimate the allowance.

Allowance Setup¶

“Set up the liability allowance account and cash discount allowance deduction from gross sales account.”

“The allowance for cash discounts is a liability account. The corresponding account - Estimated cash discounts - is shown in the income statement as a deduction from gross sales. Like the sales refunds adjustment to gross sales, this income statement account is also renamed in the income statement. It will appear as “allowance for cash discounts”. Do not be confused. The liability of same name is still on the balance sheet.”

Cash Collections¶

“Customer pays and takes discount.”

“Three accounts are affected by the entries - accounts receivable, cash and allowance for cash discounts.”

Adjusting Allowances: Month’s End¶

Updating¶

If an estimate is exact then no adjustments are required.

Appropriate entries will satisify the accounts equation.

Overestimations¶

If a value is overestimated then appropriate adjustments are made in the liabilities and owner’s equity section.

Asset section is remained untouched.

Underestimations¶

If a value is underestimated then appropriate adjustments are made in the liabilities and owner’s equity section.

Asset section is remained untouched.

Ratios¶

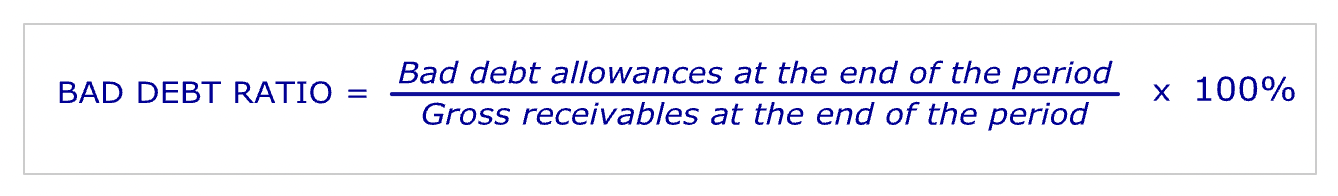

Bad Debt Ratio¶

“The bad debt ratio is the percentage of a company’s gross receivables that it does not expect to be paid. A company with a low bad debt ratio believes it is more likely to receive payment of more of its receivables outstanding than a company with a high bad debt ratio. Financial statement users use the bad debt ratio against their knowledge of the issuers’ business and industry to assess the reliability of the company’s net accounts receivable balance.”

Interpretation¶

“Bad debt ratios vary considerably from industry to industry, ranging from less than 1% to over 15%.”

“Analysts look to see if a company’s bad debt ratio is increasing over time, or if it is significantly greater than that of other companies in its industry. In either case, this might indicate that the company is failing to properly screen potential clients before offering them credit. It might also mean that the company is pursuing less credit-worthy customers in an attempt to generate sales which it is not getting elsewhere.”

“From a managerial perspective, the greater your company’s bad debt ratio is, the more it costs you to extend credit to your customers. If you are attempting to analyze the incremental profitability of a sale, the cost of providing credit to a customer is one of the costs elements to include. An increase in the cost of extending credit means a decrease in net profit from a sale.”

Days Receivable Ratio¶

“The “days receivable” ratio or the “days sales outstanding” (DSO) ratio indicates the average number of days necessary for the company to collect its outstanding accounts receivable. The days receivable ratio is sometimes called receivables turnover, because it tells you how fast the receivable are turning over and being converted into cash.”

Interpretation¶

“As is true with bad debt ratios, days receivables varies considerably between industries. Retail apparel chains have very short days receivable while heavy equipment manufacturers, by comparison, have much longer days receivable.”

“Analysts compare a company’s days receivables to that of its industry peers. The slowing of a company’s days receivables or a high days receivables compared to its competitors has a negative impact on the firm’s liquidity; it ties up capital that might otherwise be used to finance the production of saleable assets. An increasing days receivable ratio might also be an indication that more of the receivables will become bad debts.”

“In periods of economic downturn, many companies experience an increase in days receivable and bad debts as their customers find it more difficult to meet their obligations.”